Overview

Holdings Microservice is an independent service component that manages the data and operations in various financial holdings such as Lending, Deposits, Accounts, and so on. It plays a key role in data management, transaction processing, reporting and analytics, and integration with other microservices or external systems.

How Holdings Microservice Works?

Holdings Microservice provides a seamless platform to update and ensure uninterrupted near real-time static details, balances and transactions even when there is a planned outage or a stand-in processing.

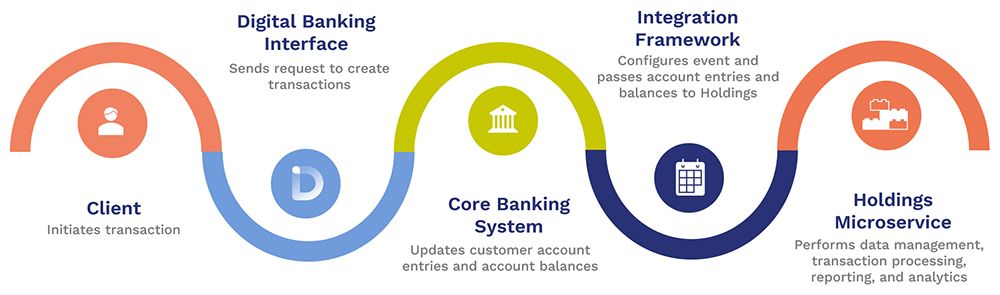

When a client initiates a transaction in a digital banking interface such as Temenos Digital, it sends a request to the core banking system to create the transactions. This transaction impacts the customer account entries and the account balances (the entries can impact customer entries, Banks’ P&L, and special entries).

Once the details are updated in the core banking system, an integration framework that integrates the customer account details, account entries, and balances with the Holdings Microservice, configures an event and passes the accounting entries and account balances to the Holdings Microservices in an asynchronous manner.

Holdings Microservice offers the following features,

- Provides near real-time integration between the core banking system and the Microservices using an Integration Framework based on different events.

- Data Events Streaming (DES) using Avro format events.

- Data Events through Outbox.

- First Class Business Events (FCBE) through Outbox.

- Provides near real-time updates to static details, entries and account balances in the client dashboard.

- Updates client positions, holdings, movements, and other related information in near real-time.

- Integrates with one or more core banking systems.

- As part of the MS Consolidation initiative, the following Business Microservices are merged within Holdings Business Microservice.

- Portfolio Holdings

- Savings Pots

- Balances and Activities

- The Holdings Business Microservice is enhanced to include all the features and persist the details offered by the Arrangement Microservice.

Architecture

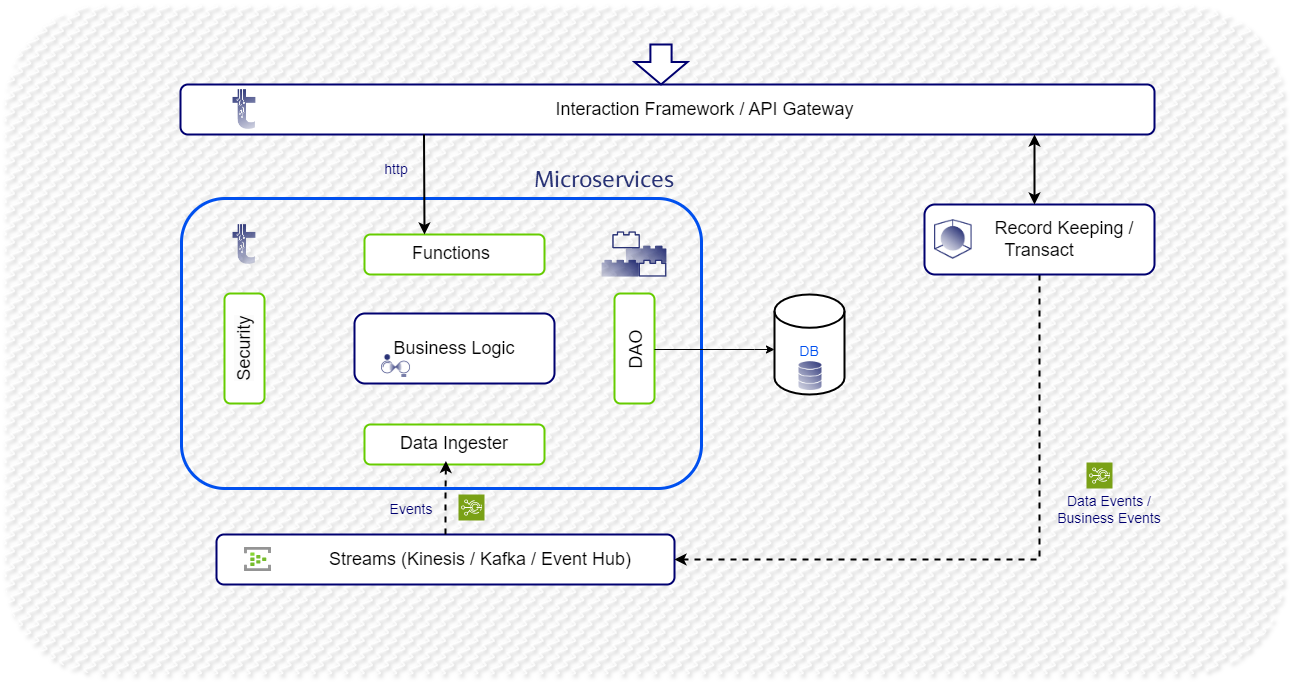

The below architecture shows the event flow from the core banking system to Holdings Microservice.

Functional Highlights

Holdings Business Microservice offers the following key functional highlights.

- Accounts Dashboard Summary

- Drilldown details such as basic details, balances, transactions, pending transactions, payment schedules for loans, and interests.

- Enrichment details such as product, security instruments, party roles, company details, posting restrictions, and different account services.

- Transactions Search

- Portfolio Holdings such as Portfolio or Customer allocations, Portfolio or Customer values and details, daily profit and loss (PL) and their percentage, Market values, Unrealized P&L and their percentage, and yearly performance.

- Balances and Activities for Pricing Processing.

- Customer or Account posting restrictions.

- Account Services opted in and out by a customer.

- Business Activity Monitor – Displays ACH, RTGS, Instant, and Cross Border payments that are both processed and unprocessed.

- STP Rate – Displays STP and non-STP payments for the current day and the past 30 days.

- Track payments – Efficiently monitors and accesses payments.

-

Identifying parties involved in arrangement as primary and beneficial owners.

Functional Capabilities

Following are the functional capabilities of Holdings Microservice.

The payment data from Transact is directly transferred to the Event Store Microservice, which is stored by the Holdings Microservice for queries on,

- Payments User Agent reports

- Business Activity monitoring (for both processed and unprocessed payments)

- Tracking payments

Following are the payment information stored in Holdings Microservice:

|

Enrichment Information |

Payment Order Details |

Payment Transaction Details |

|---|---|---|

|

|

|

Holdings Business Microservice provides an independent cloud-enabled solution for managing Savings Pots, which helps the customers create two types of Pots to save money within the main account for future spending.

|

Goal Pot |

Budget Pot |

|---|---|

|

A Goal Pot is used to periodically set aside funds to meet future goals. Following are the key features of a Goal Pot.

|

A Budget Pot is used to allocate some money for future use at any point in time. Following are the key features of a Budget Pot.

|

Holdings Microservice can persist the account, lending, or deposit information from the AC, LD, and AZ modules respectively, to support the Legacy features offered by Transact for Temenos Digital products.

Target Audience and Business Value

Following are the use cases to be considered for the Holdings bundle.

- Single source for fetching the account and contract (arrangement) details when the banks have multiple core banking systems to integrate with Temenos Digital Servicing or Temenos Composable Banking.

- High volume of users or accounts (in millions, for example, above 5M) and transactions (in multiple millions, for example, minimum of 2M) for better performance.

- The legacy core system of the bank cannot store the transaction history (previous day transactions) due to the volume of transactions.

- The legacy core system of the bank does not support APIs to integrate with Digital Servicing applications.

- TPH systems for supporting Fednow or Fedwire payments.

- IMS Bundle – In case of IMS Bundle, the respective BMS should be bundled with the IMSs - Generic Config and Event Store by default, as this is required for features like Data Ingestion, MDAL, or GDPR.

- Holdings Bundle - If Holdings BMS is positioned for a non-Transact system, it should be bundled with Adapter MS and IMS Bundle. The licensing cost should be considered accordingly.

In this topic